Trailer k epizodě 3x16 Altar of Mortis

Co přinese nová epizoda Klonových Válek s názvem Altar of Mortis? V novince je obsažen trailer.

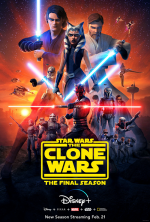

Zdroj: Cartoon Network, Netflix, Disney+

Nejlepší epizody

Reklama

Nejoblíbenější postavy

Narozeniny herců

-

Dave Filoni

7.6.1974 | 7.6.2024 -

Tom Kenny

13.7.1962 | 13.7.2024 -

James Arnold Taylor

22.7.1969 | 22.7.2024 -

Corey Burton

3.8.1955 | 3.8.2024 -

Matthew Wood

15.8.1972 | 15.8.2024

Napište nám

Našli jste chybu ve vysílání? Nemůžete se dopídit českých titulků? Chtěli byste se o tento seriál starat? Napište nám!

Diskuze /1

A corporation is owned by shareholders and is an independent business structure Chanel Replica. Here the corporation is legally liable for the actions and debts the business incurs and not the shareholders that own it. Corporations involve a much more complicated structure than other business structures because they have expensive set ups and overheads and complex tax and legal responsibilities. Hence, corporations are the advisable business structure for large chanel watches for women companies with many employees. Corporations have the right and the ability to sell ownership shares in the business through stock offerings.A limited liability company is a mixed legal structure that blends the limited liability features of a corporation and tax benefits and operational flexibility of a partnership. The owners of a LLC are designated as members whose number may be one, two or more. This business which does not resemble the liability of shareholders in a corporation is not taxed chanel shopping tote separately. In the case of a LLC the entire profits and losses are passed through the business to each member of the LLC. The members show the profits and losses on their personal tax returns, in the same way as the owners of partnerships .